Headlines

Why battery raw material prices slumped under pressure in the first half of 2023

Originally posted on source.benchmarkminerals.com

Prices of critical battery materials such as lithium, cobalt, nickel and graphite, were under pressure in the first six months of this year as a slowdown in China hit downstream demand and new supplies continued to enter the market.

Critical battery material prices declined between 20% and 40% in the first half of 2023 at a time when cathode and anode makers continued to destock existing inventories or remained cautious with new orders and producers continued to pile up supplies amid an uncertain demand scenario.

“Following a year of bumper cell production in China in 2022, the first half of 2023 saw a notable softening for battery raw materials in China, with these markets slowing down for the first time in nearly two years as downstream players took a breath in regards to feedstock purchasing whilst working through stockpiled cell inventories,” said Daisy Jennings-Gray, analyst at Benchmark.

Demand for electric vehicles in China took a hit at the start of the year following the discontinuation of a decade old New Energy Vehicle subsidy and the incoming Spring Festival. Electric vehicle sales remained weak but picked up pace in February after a Tesla-induced price war that spurred local rivals to offer steep discounts as well. In late June China extended the sales tax break for electric vehicles until 2027.

The battery material price declines also came at a time as the US and Europe moved ahead with ambitious plans to build their own critical minerals supply chains to responsibly source battery materials and challenge China’s mid and downstream dominance by the end of the decade.

According to Benchmark data, this year China alone is forecast to refine 62.5% of the world’s lithium supplies in 2023, 76% of cobalt, mine 65% of the world’s natural graphite and produce 72.5% of synthetic graphite.

Lithium starts 2023 on the back foot

Battery grade lithium carbonate and lithium hydroxide prices in China had already fallen 64% and 56% respectively in the first four months of the year, slowing down the two-year rally for the critical battery material.

Prices however recovered some ground in early May as cathode and cell makers accelerated orders despite only a moderate recovery in downstream demand. Still lithium carbonate and lithium hydroxide prices were down 40% and 42.2% overall in the first six months of 2023 data from Benchmark’s Lithium Price Assessment shows.

Cell makers started the year with high inventories spurring cathode makers to destock and make limited chemical purchases leading to an inventory build up with lithium producers and a fall in prices. Lithium traders also held back from engaging in market activity, as they waited to see if prices move lower.

Cobalt bear run continues

Cobalt sulphate and cobalt hydroxide prices fell 21.2% and 30.3% in the first six months of 2023. Cobalt metal prices have declined 51% since peaking in April last year.

In February the industry had speculated that cobalt metal prices had neared the floor but limited demand from the electric vehicle and the consumer electronics sector stoked negative sentiments and drove prices further down.

One of the most significant cobalt developments in the first six months of the year was when China Molybdenum’s Tenke Fungurume copper and cobalt mine in the DRC began exports of material in May after a 10-month ban. The move pushed prices further down. CMOC had piled up an estimated 16,000 tonnes of cobalt hydroxide during the ban which could now enter the market for sale.

Chinese graphite market meets muted downstream demand

Domestic Chinese -100 mesh 94-95% C flake graphite prices fell 20.8% and those of pre-calcined pet needle coke, the key feedstock for synthetic graphite fell 29% in the first half of the year as new capacity continued to come online despite lacklustre demand from the electric vehicle sector.

On the flake graphite front, supply from Heilongjiang Province in China has remained relatively robust from April onwards. Graphite operations are seasonally suspended from Heilongjiang Province from September to April or May. Prices usually fall in summer when more supply comes in and this year they have fallen even more because of weak demand from the electric vehicle industry.

Heilongjiang is expected to produce 60% of global -100 mesh flake graphite, the grade typically used for battery applications, this year, according to Benchmark’s Natural Graphite Forecast.

The fall in graphite prices puts increasing pressure on graphite miners, and comes as anode manufacturers report plentiful raw material inventories, especially in China.

For synthetic graphite, supply of pet coke and pet needle coke remained robust with new capacity continuing to come online and despite less efficient producers halting production.

Synthetic graphite anode producers were also being more lenient with the feedstock they could use – putting downward pressure on low sulphur coke prices.

China continues to lead global coke production, and by 2030 the country is projected to account for a near 75% share of global supply of coke, according to Benchmark Synthetic Graphite Forecast.

Nickel rally loses steam in first half

Nickel sulphate prices retreated by 20% in the first half of 2023 due to muted demand from the electric vehicle sector and the weak NCM demand recovery. Prices did rise in February when producers rushed to buy additional material given the sizable arbitrage between the Chinese and the international prices. Prices also rose slightly in June amid firming downstream demand.

Nickel sulphate prices have been on a generally bearish trajectory since October 2022. In April Chinese nickel sulphate prices reached their lowest levels since June 2021 only to recover moderately.

For the most of the first half in 2023, nickel demand remained constrained as existing inventories were prioritised over sourcing new feedstock.

2022 marked a record year for capacity additions and expansions with refined nickel production increasing by 18% year-on-year to 3.2 million tonnes. This is set to grow by a further 6% in 2023, to 3.4 million tonnes, largely driven by a 50% increase in Indonesia’s nickel output, according to Benchmark Nickel Forecast.

Indonesia is emerging as a key nickel producer and Benchmark forecasts that Indonesian nickel production for the battery industry will grow by over 600% this decade, thanks to significant Chinese investment in processing plants.

Canada to speed up critical minerals permits in bid to erode China's dominance

Originally posted on Bloomberg.com

Prime Minister Justin Trudeau’s government hopes to unveil a plan by the end of this year to streamline permitting for mining projects as the US and its allies push to accelerate the production of critical minerals in North America.

Canada faces mounting pressure to keep pace with its southern neighbor as the US ramps up efforts to secure the metals needed for electric vehicles, solar panels and wind turbines. American lawmakers have been debating legislation that could substantially speed up approval times for resource projects.

While Canada is home to significant deposits of key minerals, it can take anywhere between five and 25 years to develop them into a mine. This timeline poses a significant challenge to Canada’s dreams of becoming a key player in the US-led drive to topple China’s dominance in the sector.

US negotiations to introduce permitting reform legislation make it all the more urgent for Canada to accelerate mine building timelines, said Heather Exner-Pirot, special adviser with the Business Council of Canada.

“We know the Americans are getting much more serious on permitting reform as commodity prices go up and we start to see some shortages of critical metals,” she said. “If we want to be in the critical minerals business, we have to move on it.”

Ideally the Trudeau government will have its plan ready by a budget update due in the fall, according to an official familiar with the matter. It will seek to enforce legislation passed in 2019 that was designed to cut regulatory hurdles that can stall mining projects for more than a decade, the official said.

Permitting backlogs have largely stemmed from underfunding at agencies tasked with approving permits as well as a lack of coordination between the federal government and its provincial counterparts. The 2019 legislation — the Impact Assessment Act — was supposed to reduce permit timelines to a maximum of five and a half years by setting time limits on assessments and approvals, though in practice projects still experience delays well beyond that time frame.

The process creates uncertainty for investors, sometimes resulting in funding shortfalls for mine builders, said Exner-Pirot.

“It’s a very political process, and from an investor perspective that creates uncertainty and risk. You don’t know if a politician is going to put the brakes on a mine development five years from now,” Exner-Pirot said in an interview.

Mining projects are also subject to rigorous environmental assessments, both at the federal and provincial level, and often face opposition from neighboring Indigenous communities that may be vulnerable to the hazards of operations. Natural Resources Minister Jonathan Wilkinson has acknowledged the need to speed up permitting but vowed not to compromise environmental standards or Indigenous consultation.

One high-profile example of Canada’s lengthy process is Ontario’s “Ring of Fire,” a metals-heavy region seen as key to Canada’s critical minerals ambitions. Projects in the area have sat undeveloped for nearly two decades as mining companies struggle with permitting delays and opposition from some indigenous groups.

Recent high-level government departures have added to Canada’s challenge in making reforms. The permitting review was initially spearheaded by Janice Charette, the top federal civil servant, and Michael Sabia, the top Finance Department official. But both chose to leave government in the past two months.

John Hannaford, who replaced Charette at the top of the federal bureaucracy, is now helping shepherd the review along with Paul Halucha, a top official in the Environment department. Mollie Johnson, a senior official in the Natural Resources department who has been working on it, is moving to a new role as deputy secretary to the cabinet on July 24, the prime minister’s office announced Friday afternoon.

Financing the battery arms race: the $514 billion cost of bridging the global EV supply chain divide

Originally posted on Benchmark Source

Globally, the battery industry needs to invest at least $514 billion across the whole supply chain to meet expected demand in 2030, and $920 billion by 2035, according to a new analysis by Benchmark.

Demand for lithium ion batteries is forecast to grow to 3.7 terawatt-hours by 2030, up from around 1 TWh this year. Most of this growth is driven by an ever increasing demand for electric vehicles.

Producing the critical raw materials will require $220 billion (43% of the total), with nickel and lithium accounting for over half of that. Manufacturing the additional 2.7 TWh of batteries needed by 2030 will require $201 billion and the midstream production of battery materials will take the remaining $93 billion.

The amount is just a fraction of the estimated $35 trillion needed to be spent on the energy transition by 2030, according to the International Renewable Energy Agency. This includes spending on renewables such as wind and solar as well as grid and other infrastructure.

Global investment in technologies to help the energy transition reached a record $1.3 trillion in 2022, IRENA said.

“The energy transition is still in its early stages and massive capital deployment is going to be needed in order to meet the goals of industry and policy makers,” Andrew Miller, Benchmark’s chief operating officer, said. “Energy storage might form a relatively small piece of the overall financing required, but it is a strategically critical piece of the puzzle. Batteries are the platform technology for clean energy goals, so financing these supply chains is at the heart of the race towards net zero.”

Critical Raw Materials

This year is expected to see over a million tonnes LCE of lithium mined for the first time, according to Benchmark’s Lithium Forecast.

By 2030 this number will need to increase to 2.8 million tonnes, with almost all of this demand growth driven by the need for lithium ion batteries. Benchmark’s analysis shows that the expansion of the global lithium industry will need $51 billion of investment.

Benchmark’s view is that lithium, more than any other part of the supply chain, will be the bottleneck for the growth of the battery industry. To put the scale of the lithium challenge into context, more lithium will be needed in 2030 than was mined between 2015 and 2022, according to Benchmark’s Lithium Forecast.

Refined nickel, too, will pose a challenge. With a near two million tonne supply gap between what is in production today and what is needed globally by 2030, nickel requires the largest critical mineral investment of $66 billion.

Most nickel demand is for non-battery applications with stainless steel accounting for half of global nickel demand in 2030. However, batteries are the fastest-growing demand market for nickel. This year nickel demand from batteries is just 15%, but this is forecast to rise to 32% by 2030, according to Benchmark’s Nickel Forecast.

Natural and synthetic graphite are forecast by Benchmark to have a combined supply gap of 3.6 million tonnes, but the relatively lower capital requirements for graphite mines and synthetic graphite production facilities results in an investment need of $4.3 billion.

The rise of gigafactories

In 2030, Benchmark forecasts that annual global demand for lithium ion batteries will hit 3.7 TWh, as assessed in Benchmark’s Lithium ion Battery Database. This year, the world is forecast to produce 1.0 TWh.

Closing this 2.7 TWh gap will need $201 billion of investment. Most of this (56%) will be put towards building 1.2 TWh of new gigafactories on greenfield sites. The remaining $89 billion is needed to expand and develop brownfield sites where industry players such as CATL are already operating, and thus capex intensity is lower.

Cathodes and anodes

Although the lion’s share of investment into the battery supply chain is needed for critical raw materials and gigafactories, anode and cathode production still requires significant attention.

Indeed, Benchmark’s analysis suggests cathode production will require $40 billion and anode production $15 billion to close the supply gap currently looming over 2030.

Without investment into the midstream, the gigafactories won’t be able to operate at full capacity if access to anodes and cathodes becomes a bottleneck.

The bulk of investment into cathode production will need to focus on the two chemistries that are emerging as most popular: lithium iron phosphate (LFP) and NCM811.

Electrolytes and separators also need significant investment, with Benchmark’s analysis showing that the area needs $38 billion to close the supply gap by 2030.

Adding the cost of geopolitics

Currently, China dominates in every segment of the battery supply chain. With this, the country has built up substantial expertise in building the required production facilities at a relatively low cost.

The $514 billion bill for the industry will likely grow as countries increasingly look to develop regional supply chains. Take US lithium producer Albemarle, for example: their lithium refinery in Meishan, China, is projected to cost around $500 million for 50,000 tonnes LCE. Their equivalently sized facility in South Carolina, USA is projected to cost $1.3 billion.

IRA tax credits may lessen the burden on companies operating in the US, but ultimately the bill has to be paid, whether by a company or a government subsidising the industry.

Timeline considerations

A gigafactory can be built in two to five years. A refinery can be built in two. But the mines needed upstream of them take between 5 and 25 years to develop.

So even though gigafactories require the largest amount of investment, it is imperative that investment is made now in the mines. Otherwise, the gigafactories will stand idle with production constrained by limited feedstock.

The industry must use joined-up thinking to ensure all aspects of the supply chain grow in tandem to maximise efficiency, according to Simon Moores, chief executive of Benchmark.

Critical Mineral Projects Capital Constrained as Banks Neglect to See Past Lithium

Originally posted on theassay.com

Despite the growing need for increased critical minerals production, junior mining companies are struggling to receive the necessary funding to support new and ongoing projects.

“We’re in a supply and demand situation where everybody is saying they want more supply and there’s not a lot of financing alternatives available.” Richard Pearce, president and CEO of junior miner South Star Battery Metals Corp. (TSXV:STS) told S&P Global Commodity Insights at the 121 Mining Investment conference in New York.

A junior mining company is one that generates under US$50M in annual revenue, according to Commodity Insights classification, and they would like to see more.

“Bankers haven’t wrapped their brains around battery metals aside from lithium,” said Pearce. The energy transition narrative “would have you believe that there is only lithium in a lithium-ion battery.”

Battery metals include a variety of commodities including copper, cobalt, graphite, nickel, manganese, and vanadium. Limited understanding can result in low valuations, often meaning early-stage projects are overlooked by large investment funds, according to US Critical Metals Corp. (TSXV:USCM) CEO, Darren Collins.

“You have a very limited spectrum of [projects] which would be of sufficient market capitalization for these companies to participate as large institutional managers.” Collins said.

Investors can be unwilling to wait for returns from small companies with long lead times before they can be made profitable, according to industry participants.

Michael Williams, executive chairman of Aftermath Silver Ltd. (TSXV: AAG), called mining ‘a tough industry’ adding that, “when you do make these discoveries and bring them forward, it’s a very rewarding industry for everyone.”

A slowing global economy is also tightening the available capital for junior explorers and miners.

“That’s really the big impact for the smaller companies…There’s just not as much money available to fund our ongoing needs,” said Stuart Harshaw, president and CEO of Nickel Creek Platinum Corp. (TSX: NCP).

“You’re going to start to see projects stalled, if we have a significant deterioration in global capital markets as a result of inflation, interest rates increasing and overall general debt issues.” US Critical Metals’ Collins said.

This could lead to shortages for materials crucial to the energy transition, pushing prices up further, thereby motivating more exploration.

“The longer explorers aren’t able to do any exploration, the less product that’s going to be available, and therefore, the higher the price will go.” said Harshaw.

Critical Minerals Are Critical to The World’s Future

Originally posted on theassay.com

It wasn’t that long ago that miners were considered a global environmental scourge. Nowadays, in many quarters, miners are considered a key to saving the world’s environmental future – thanks to critical minerals.

What are critical minerals and why are they critical?

International law firm, Gowling WLG, says the pivotal role of critical minerals, particularly lithium, in the worldwide shift to net-zero has given a major boost to the image of the mining industry as a potential partner to meet net-zero emission targets.

Following the landmark Paris Agreement in December 2015, countries have gradually escalated their efforts to meet the commitments set out in the accord, whose 200 signatories promised to keep global warming below two degrees Celsius this century, and ideally below 1.5 degrees, to avoid the worst effects of climate change.

However, Russia’s invasion of Ukraine in 2022 caught Europe and the world unprepared, leaving many western nations with a large hole in their energy supplies. This shock created an immediate and desperate need to lessen the world’s dependency on fossil fuels.

Now, rather than searching for replacement sources of fossil fuels to replace Russian imports, European countries are accelerating their adoption of greener fuels and transforming international energy markets, according to the International Energy Agency (IEA), which forecasts global clean energy investment will exceed US$2T per year by 2030 as a result.

Governments and even environmentalists, agree that critical minerals are vital for clean energy and advanced technologies like smartphones, computers, solar panels, batteries, and electric vehicles.

According to US-based IEA, critical minerals such as lithium, graphite, copper, nickel, cobalt, and rare earth elements are essential components in many of today’s rapidly growing clean energy technologies – from wind turbines and electricity networks to electric vehicles.

Demand for these minerals will grow quickly as clean energy transitions gather pace. The types of mineral resources used vary by technology. Lithium, nickel, cobalt, manganese, and graphite are crucial to battery performance. Rare earth elements are essential for permanent magnets that are used in wind turbines and EV motors. Electricity networks need a huge amount of copper and aluminium, with copper being a cornerstone for all electricity-related technologies.

Critical Minerals Lists

Many leading governments and agencies have identified different minerals and reasons for creating critical minerals lists. The number and type of minerals varies by location.

The Society for Mining, Metallurgy & and Exploration (SME), says critical and strategic minerals are essential to economic and national security of nations like the United States and the other 84 countries that its members span across.

The organization website states that critical minerals “are key to manufacturing and agricultural supply chains, and to the successful deployment of modern technologies in a variety of industries, including telecommunications, national defence, and both conventional and renewable energy.”

The US Geological Survey has named 50 minerals that are deemed ‘critical,’ Canada has a list of 31 minerals, and Australia only considers 26 resource commodities to be critical minerals.

Geoscience Australia defines critical minerals as: metals and non-metals that are considered vital for the world’s economies, technologies, or national securities, yet is at a risk of supply chain disruptions due to geological scarcity, geopolitical issues, trade policies, or other factors.

Echoing that sentiment is the University of Adelaide in Australia, which defines critical mineral as metals and non-metals that are irreplaceable inputs for society’s future, including in renewable energy systems, infrastructure, transport, high tech equipment, and defence systems.

Nearly all institutions, organizations, and governments have similar definitions, but the actual approved list can vary for which minerals make the cut as a top priority.

Government Investment

The importance of critical metals to the world’s green future has created a major ‘arms race’ by leading nations to scramble to ensure they aren’t left behind.

Canada

In the last year, the Canadian federal government launched its Canadian Critical Minerals Strategy, staking a claim for the country to become a global supplier of choice in the evolving commodities market.

The strategy, released in December 2022 and backed by almost C$4B in financial commitments over the next eight years, detailed their plans for over 30 minerals that the federal government considers critical because of their strategic value, limited reserves, and increasing concentration in terms of extraction and processing.

Australia

Australia, a leading producer of many critical metals, is considered an early mover in the race to shore up its own supplies – and to identify new markets for its natural bounty.

The A$2B Critical Minerals Facility, administered by Export Finance Australia, offers financing to get early-stage critical minerals projects off the ground.

It is just one of many critical minerals focused support programmes offered by the Australian Federal and State and Territory Governments.

A new three-year A$50M Critical Minerals Development Program will offer competitive grants to early and mid-stage projects. The Federal Government has also unveiled an A$1B Value Adding in Resources Fund aims to ensure a greater share of the local raw materials are processed in Australia. It forms part of the Australian Government’s $15B National Reconstruction Fund.

USA

With a major focus on creating a home-grown supply network and to diversify away from Chinese critical minerals supplies, the Biden Government is investing billions into new exploration and production, particularly for metals such as lithium and rare earth elements (REEs).

Demand

Analysts, governments, and international agencies are forecasting trillions of dollars will need to be invested into critical minerals exploration and development as the world races towards a ‘clean energy’ future.

According to the IEA, to reach net-zero emissions by 2050, annual clean energy investment worldwide will need to more than triple by 2030 to around US$4T.

In its Energy Technology Perspectives 2023 report, the IEA analysis shows the global market for key mass-manufactured clean energy technologies will be worth around US$650B a year by 2030 – more than three times today’s level – if countries worldwide fully implement their announced energy and climate pledges.

The related clean energy manufacturing jobs would more than double from 6M today to nearly 14M by 2030 – and further rapid industrial and employment growth is expected in the following decades as transitions progress.

EVs and Batteries

EVs and batteries are fuelling much of the demand. The Global Battery Alliance says that thedemand for batteries will see exponential growth and as the world seeks emission-free energy alternatives, batteries are an essential component of our future.

The World Bank Group report projects that the “production of minerals such as graphite, lithium and cobalt could increase by nearly 500% by 2050 to meet growing demand for clean energy technologies.”

Who Will Finance the Energy Transition's Mining Projects?

Originally posted on Investingnews.com

“The issue is that it seems to be easier to raise money if you're building a gigafactory than if you are building a mine," said Simon Moores of Benchmark Mineral Intelligence.

Lithium-ion batteries are at the forefront of the electric vehicle and energy storage revolution, and they've been attracting more attention as governments continue looking for ways to phase out fossil fuels in favor of greener energy sources.

As the platform technology for the energy transition, lithium-ion batteries feed into three core industries — electric vehicles, solar energy and wind energy — but the sector is also still being built from scratch, Benchmark Mineral Intelligence CEO Simon Moores said during a keynote at the Battery Gigafactories Europe event in March.

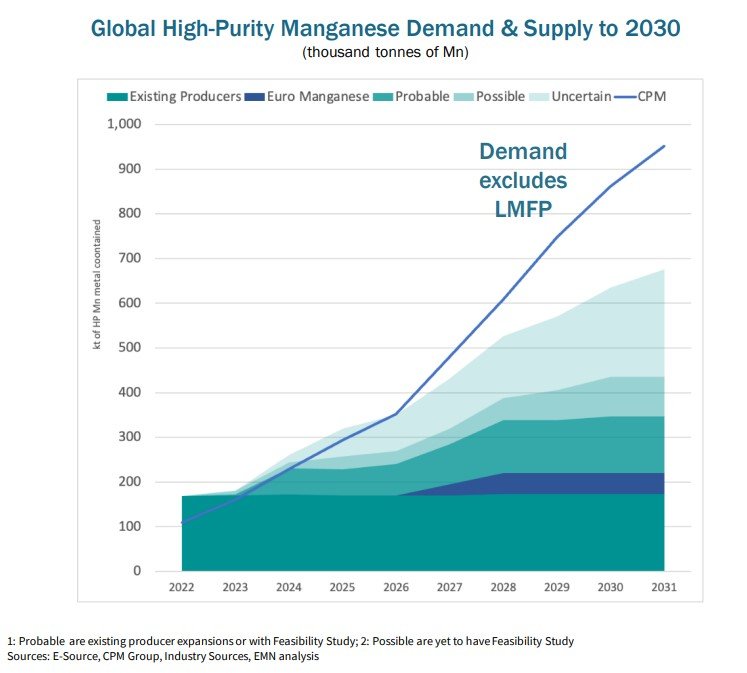

“When you look at the amount of critical minerals supply that goes into this one technology, there are five key critical minerals supply chains that have to be scaled: lithium, nickel, cobalt, graphite and manganese,” he said. “These are specialty chemicals — they are not just commodities, not just minerals. So that's a challenge.”

According to Benchmark Mineral Intelligence data, there are 187 gigafactories active today, up from 144 just two months ago.

“187 gigafactories active with a total capacity of 1.7 terawatt hours … that cost US$150 billion to get to that level,” Moores said. “The issue is that it seems to be easier to raise money if you're building a gigafactory than if you are building a mine.”

To reach net-zero goals by 2050, the industry will need to grow to a maximum of 20 terawatt hours.

“At a maximum of 20 terawatt hours, how much money will be needed? If we add battery cells, gigafactories, all the way up to the mine, it's about US$5 trillion,” Moores said. “Sounds like a lot, but if you take the entire energy transition into account that will cost about US$100 trillion … 5 percent of the energy transition tab is lithium-ion batteries.”

For Moores, of the US$5 trillion that is needed, one-third should be allocated to battery capacity and two-thirds to the upstream.

“The money and the thinking needs a shift from the mid-low to mid-hundreds of millions (of dollars) into the early billions if we are to stay on track for this energy transition,” he told the audience in Budapest. “What we're building today is just the start. It might feel like it's a far cry from where we were five years ago, but actually it is just the start and it is happening.”

Financing remains a key challenge for raw materials

According to Benchmark Mineral Intelligence, if the world is to meet the increasing demand for battery metals, 59 new lithium mines, 62 new cobalt mines and 72 new nickel mines will be needed by 2035 (without including recycling).

However, financing, together with permitting, is still a hurdle for projects to come online. Discussing the roadblocks to securing investments during a panel at the Battery Gigafactories Europe conference, Franklin Templeton’s Anthony Tse said that one of the biggest challenges is the lack of talent and the lack of experience.

Today demand is growing at a pace whereby somewhere between 10 and 12 new projects must come online every single year, Tse said. He was formerly the managing director and CEO of Galaxy Resources, which is now Allkem (ASX:AKE,OTC Pink:OROCF).

“We don't have enough roadmaps to execute on these projects going forward,” he pointed out. "And therefore, that's also going to be creating a hindrance, both from an equity side, but also from a debt provider side."

Societe Generale's (OTC Pink:SCGLF,EPA:GLE) Csaba Bellay also spoke about financing for the energy transition during the Hungary-based event. Sharing his thoughts with the audience, he said that when it comes to difficulties financing projects, currently it really comes down to the four cornerstones of structured finance.

“Who's going to build your project? What's the project going to sell? Who's going to buy the stuff that you're building? Where is the technology going to come from?” he said. “Raw materials is the most important part of these four lists, particularly in Europe.”

For Nishant Das of Standard Chartered (LSE:STAN,OTC Pink:SCBFF), the key challenge will be education.

“I think, ultimately, for project finance to succeed, we need to have an established risk allocation which works. The standards are not quite there,” he said. “So it's a question of banks — project finance banks — working closely with industry players and trying to put in place those frameworks, and the initial deals are the hardest.”

Also sharing his insight on financing challenges was Tim Van Pelt of ING (NYSE:ING), who said the path to success is quite narrow.

“All stars need to align to make these types of things work. That equally holds true, or maybe even more so, for the projects that need to come online for the upstream,” he said. “It's clear that if you have any kind of shiny gigafactory, but you don't have supply, nothing really matters anymore — it doesn’t work.”

Cobalt to Remain Key EV Raw Material Despite Substitution Threats

Originally posted on investingnews.com

The Cobalt Institute's 2022 market report shows that cobalt will continue to play a key role in the energy transition, with demand doubling by 2030.

Weaker market conditions have put cobalt prices under pressure in the past few months, but the long-term outlook for the key battery metal remains robust, says the Cobalt Institute in its latest market report.

“The cobalt industry is optimistic the cobalt market will continue to grow in the coming years, driven by the success of cobalt’s use in superalloys and hard metals, and particularly in electric vehicles (EVs),” Caroline Braibant, interim director general at the Cobalt Institute, said. “Cobalt-containing batteries are key for EVs safety, performance and stability — a factor that will continue to define consumer preferences in Europe and North America.”

The report, prepared by Benchmark Mineral Intelligence for the Cobalt Institute, forecasts that cobalt will remain a key raw material for the entire battery supply chain, despite the persistent theme of substitution in battery applications.

“Multiple cell formulations (mostly nickel-cobalt-manganese and lithium iron phosphate) will support the major end-use sectors, with no single battery cell technology expected to dominate,” the report states.

Last year, demand for cobalt saw a slight increase compared to 2021, rising by 21,000 tonnes to 187,000 tonnes. Battery applications now account for 72 percent of cobalt demand, up from 55 percent in 2018 and 70 percent in 2021.

“After being neck and neck in 2021, the EV sector is now by far the largest cobalt consumer after pulling ahead of portable electronics — it now accounts for 40 percent of total cobalt demand, with this share continuing to rise,” the report reads.

Looking over the supply side, last year mined cobalt output grew faster than in 2021, with the Democratic Republic of Congo remaining the leading producer worldwide. Indonesia took over the second spot in 2022, leaving Australia and the Philippines behind.

“Having produced minimal volumes prior to 2021, Indonesia’s rise has been fast owing to existing mining expertise in the country from other commodities and the successful construction and ramp up of HPAL capacity, producing cobalt and nickel, from Chinese-Indonesian companies,” as per the report.

Cobalt supply reached close to 198,000 tonnes in 2022, up 21 percent year-on-year.

But a main trend that will continue to impact the cobalt market is governments around the world pushing for more localized supply chains. The US Inflation Reduction Act and Europe’s Critical Raw Materials Act are just a couple of examples of how legislation could shape the building of supply chains that are less reliant on Asia.

“China dominates processing of critical battery raw materials — regionalized supply chains particularly in North America and Europe need to be developed, requiring significant investment and cooperation,” the report reads.

Cobalt outlook to 2030 looking bright

All in all, the outlook for cobalt remains strong, with demand expected to double by 2030. The leading demand driver will continue to be the EV segment, accounting for 89 percent of growth, followed by energy storage at 3 percent and superalloys at 2 percent.

“Despite the rising share of lithium-iron-phosphate, cobalt-containing cathode chemistries (nickel-cobalt-manganese, nickel-cobalt-aluminum and lithium-cobalt-oxide) will remain as the preferred technology choice for battery applications – accounting for 59 percent of total cathode demand in 2030,” the report states.

Supply is also expected to increase significantly by 2030, jumping from more than 200,000 tonnes this year to about 318,000 tonnes. The DRC will remain the leading producer, although its market share will fall by that time.

“Indonesia is the second largest market by some margin and will quickly catch up with the DRC as a major driver of growth,” the report explains. “From 2022 to 2030, Indonesia has the potential to increase cobalt supply by 10 times, compared to the DRC’s output rising by two thirds.”

The cobalt market will remain well supplied until around 2025, when it is expected to shift to a structural deficit.

“Demand growth of 10 percent CAGR is forecast to 2030, compared to 6 percent for supply,” according to the report. “With additional supply required to fill the widening forecast deficit, cobalt prices will move higher to incentivise investment.”

In the meantime, prices are expected to average around US$18 per pound through 2023, at a similar level to prices in late March.

EV sales are soaring and oil use is about to peak

Originally posted on Mining.com

Today, we at BloombergNEF published our annual Electric Vehicle Outlook. The report looks at how the different segments of road transport could evolve over the coming decades and maps the impact on oil markets, electricity demand, batteries, metals and materials, charging infrastructure and greenhouse gas emissions.

There’s a lot of different angles within a big report like this. Here are a few I’d like to highlight:

EV sales will surge in the coming years

The share of electric vehicles in sales of new passenger vehicles is set to more than double globally in the next few years — to 30% in 2026. Their penetration in some markets will be even higher, with EVs reaching 89% of sales in the Nordics, 52% in China and 42% in Europe. Our latest near-term EV sales outlook is brighter than what BNEF published last year, mostly due to policy changes in the US, where a major investment push sparked by the Inflation Reduction Act will help more than triple the share of EVs in new sales, to 28% by 2026.

Peaks everywhere

Sales of combustion-engine vehicles peaked six years ago and are now in long-term decline. Oil demand from road transport is also very close to cresting.

EVs of all types are already displacing 1.5 million barrels of oil a day. This will increase dramatically in the coming years, leading to demand for road fuels peaking in 2027. Uptake in the US and Europe has already crested, while it’s expected to peak in China next year. Oil demand from two-wheelers, three-wheelers and buses has also peaked, with demand from passenger cars following in 2025. Commercial vehicles will take longer to shift as heavy trucks continue to rely largely on diesel.

Battery factory spending ahead of plan

BNEF models two main scenarios in its EV outlook. The Economic Transition Scenario — which assumes no new policies and regulations are enacted — is primarily driven by techno-economic trends and market forces. The Net Zero Scenario investigates what a potential route to net-zero emissions by the middle of the century looks like for the road transport sector.

Large investments are needed in all areas of the battery supply chain, but some areas are already running ahead of what’s required to stay on track to eliminate emissions by 2050. BNEF estimates that between $24 billion and $57 billion in battery and component plant investment is needed each year to keep up with demand. It’s looking good: Spending already totaled $59 billion in 2022.

Lithium has a supply challenge

Lithium is the most concerning of the battery metals in terms of supply, with demand increasing 22 times by 2050 under BNEF’s Net Zero Scenario.

Building more public chargers can help consumers feel comfortable with shorter EV ranges and smaller battery packs — which in turn reduces pressure on the supply chain. While battery recycling will also help, it won’t deliver large volumes until the 2030s.

Still, there are reasons for optimism. Sodium-ion ion batteries, which are entering commercialization this year, could reduce lithium demand by nearly 40% in 2035 compared to BNEF’s base case scenario. Advances like solid-state batteries and next-generation anodes are also entering the market.

Electricity demand from EVs

The rising adoption of EVs adds about 14% to global electricity demand by 2050 in the Economic Transition Scenario and only 12% in the Net Zero Scenario — despite more vehicles on the road. That’s because the Net Zero Scenario includes additional consumption from electrification of heating, industry as well as electrolyzer use for hydrogen production in other sectors.

This year’s report includes five new thematic highlights, each of which explores a different part of the transition in markets around the world. The topics are:

EV price parity under different battery price scenarios

Will average EV ranges keep rising?

Emerging battery technologies: sodium-ion batteries, solid-state batteries, and next-generation anode technologies

High-powered charging for trucking fleets

The impact of autonomous vehicles

(By Colin McKerracher)

Global EV Outlook 2023

Originally posted on IEA.ORG

The global auto industry is undergoing a sea change, with implications for the energy sector, as electrification is set to avoid the need for 5 million barrels of oil a day by 2030

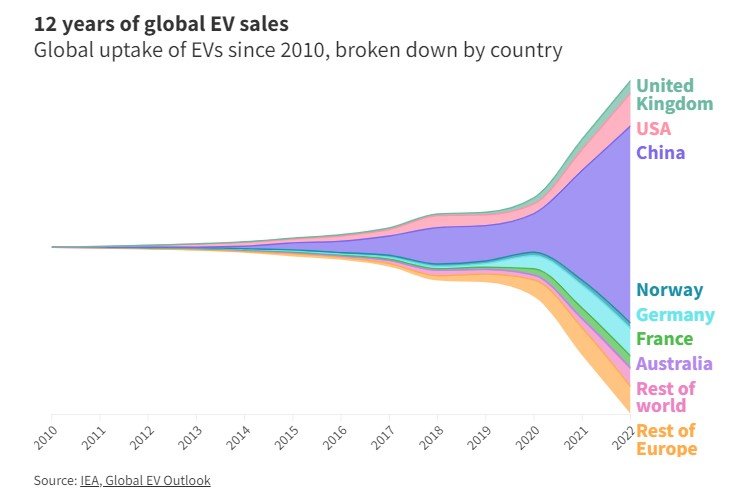

Global sales of electric cars are set to surge to yet another record this year, expanding their share of the overall car market to close to one-fifth and leading a major transformation of the auto industry that has implications for the energy sector, especially oil.

The new edition of the IEA’s annual Global Electric Vehicle Outlook shows that more than 10 million electric cars were sold worldwide in 2022 and that sales are expected to grow by another 35% this year to reach 14 million. This explosive growth means electric cars’ share of the overall car market has risen from around 4% in 2020 to 14% in 2022 and is set to increase further to 18% this year, based on the latest IEA projections.

“Electric vehicles are one of the driving forces in the new global energy economy that is rapidly emerging – and they are bringing about a historic transformation of the car manufacturing industry worldwide,” said IEA Executive Director Fatih Birol. “The trends we are witnessing have significant implications for global oil demand. The internal combustion engine has gone unrivalled for over a century, but electric vehicles are changing the status quo. By 2030, they will avoid the need for at least 5 million barrels a day of oil. Cars are just the first wave: electric buses and trucks will follow soon.”

The overwhelming majority of electric car sales to date are mainly concentrated in three markets – China, Europe and the United States. China is the frontrunner, with 60% of global electric car sales taking place there in 2022. Today, more than half of all electric cars on the road worldwide are in China. Europe and the United States, the second and third largest markets, both saw strong growth with sales increasing 15% and 55% respectively in 2022.

Ambitious policy programmes in major economies, such as the Fit for 55 package in the European Union and the Inflation Reduction Act in the United States, are expected to further increase market share for electric vehicles this decade and beyond. By 2030, the average share of electric cars in total sales across China, the EU and the United States is set to rise to around 60%.

The encouraging trends are also having positive knock-on effects for battery production and supply chains. The new report highlights that announced battery manufacturing projects would be more than enough to meet demand for electric vehicles to 2030 in the IEA’s Net Zero Emissions by 2050 Scenario. However, manufacturing remains highly concentrated, with China dominating the battery and component trade – and increasing its share of global electric car exports to more than 35% last year.

Other economies have announced policies to foster domestic industries that will improve their competitiveness in the EV market in years to come. The EU’s Net Zero Industry Act aims for nearly 90% of annual battery demand to be met by domestic battery manufacturers. Similarly, the US Inflation Reduction Act places emphasis on strengthening domestic supply chains for EVs, batteries and minerals. Between August 2022, when the Inflation Reduction Act was passed, and March 2023, major EV and battery makers announced investments totalling at least USD 52 billion in EV supply chains in North America.

Despite a concentration of electric car sales and manufacturing in only a few big markets, there are promising signs in other regions. Electric car sales more than tripled in India and Indonesia last year, albeit from a low base, and they more than doubled in Thailand. The share of electric cars in total sales rose to 3% in Thailand, and to 1.5% in India and Indonesia. A combination of effective policies and private sector investment is likely to increase these shares in the future. In India, the government’s USD 3.2 billion incentive programme, which has attracted investments worth USD 8.3 billion, is expected to increasing battery manufacturing and EV rollout substantially in the coming years.

In emerging and developing economies, the most dynamic area of electric mobility is two- or three-wheel vehicles, which outnumber cars. For example, over half of India’s three-wheeler registrations in 2022 were electric, demonstrating their growing popularity. In many developing economies, two- or three-wheelers offer an affordable way to get access to mobility, meaning their electrification is important to support sustainable development.

Breaking down clean energy funding in the Inflation Reduction Act

Originally posted on Mining.com

Breaking down clean energy funding in the Inflation Reduction Act

The Inflation Reduction Act (IRA), signed into law on August 16, 2022, is the largest climate legislation in U.S. history.

Along with fighting inflation and boosting domestic manufacturing, the IRA ultimately aims to help the U.S. achieve its goal of reaching net-zero emissions by 2050.

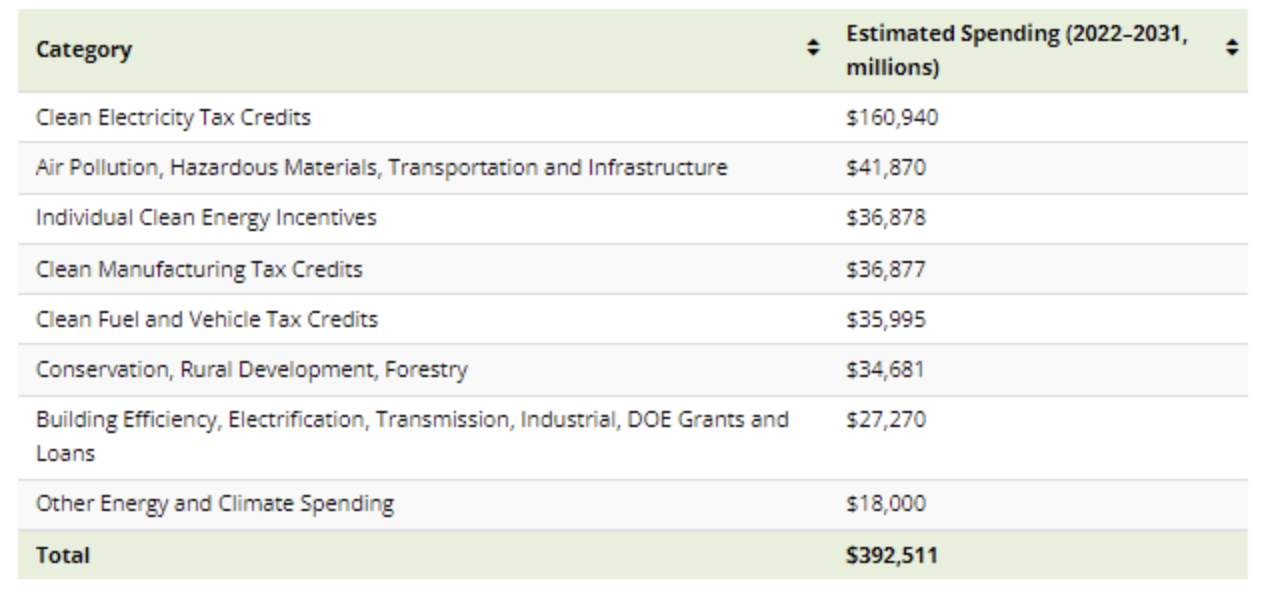

This infographic breaks down the $392.5 billion in clean energy and climate spending in the Inflation Reduction Act, based on estimates from the Congressional Budget Office.

Note: The figures in the graphic and article refer to the IRA’s estimated spending for each program. Spending estimates tend to be lower than the total amount of funds allocated by the act.

Deconstructing the Inflation Reduction Act

The IRA’s clean energy and climate spending can be broken down into seven broader categories:

Clean Electricity Tax Credits, which include the Clean Electricity Production Tax Credit (PTC) and Investment Tax Credit (ITC), account for the largest share of climate spending at 41% of the $392.5 billion.

Furthermore, the IRA mobilizes around $42 billion for programs aimed at air pollution, hazardous materials, and infrastructure. The Individual Clean Energy Incentives and Clean Manufacturing Tax Credits programs each receive $37 billion to incentivize residential clean energy use and domestic manufacturing of clean technology components.

Below, we’ll unpack the IRA’s clean energy spending in further detail.

Clean electricity tax credits

Of the $161 billion of funding for Clean Electricity Tax Credits, $132 billion is for just three programs.

The Credit for Electricity Produced from Renewable Sources is a PTC that provides from $5 to $25 per megawatt-hour (MWh) of electricity generated from renewable facilities. Wind, solar, geothermal, marine, biomass, hydro, and landfill gas facilities are eligible for this credit.

The Clean Electricity Investment Credit is an ITC with a base credit of 6% (rising to 30% if other requirements are met) on the total cost of installed equipment for a zero-emissions power generation facility. Besides renewables, nuclear, fuel cells, and battery storage systems qualify for this credit.

Nuclear is set to get a $30 billion boost through the Zero-Emission Nuclear Power Production Credit, which offers from $3 up to $15 per MWh of electricity generated from nuclear reactors. This is applicable for all reactors in service in 2024 and continues through 2032.

Clean electricity projects can either claim the PTC or the ITC (not both). Projects with high capital costs are likely to benefit from the ITC. On the other hand, projects with high capacity factors could benefit from credits per unit of electricity from the PTC.

Air pollution, hazardous materials, transportation and infrastructure

Nearly half the spending for programs in this category–around $20 billion—is for the Greenhouse Gas (GHG) Reduction Fund.

The GHG Reduction Fund, managed by the Environmental Protection Agency (EPA), aims to provide grants for clean energy and climate projects that reduce GHG emissions, with a focus on low-income and disadvantaged communities.

Similarly, other policies in this category provide the EPA with funding for grants to reduce various kinds of air pollution and curb hazardous material usage.

Individual clean energy incentives

The IRA provides various tax credits to incentivize clean energy use and energy efficiency in American households.

The Residential Clean Energy Credit, accounting for $22 billion in spending, provides a 30% credit on the cost of residential clean energy equipment. This includes rooftop solar panels, geothermal heating systems, small wind turbines, and battery storage systems.

The Nonbusiness Energy Property Credit, now known as the Energy Efficient Home Improvement Credit, offers up to $3,200 annually for energy efficient home upgrades, including insulation, heat pumps, efficient doors, and more.

Clean manufacturing tax credits

Besides energy generation, the IRA incentivizes domestic manufacturing of clean technologies with the following credits:

The Advanced Manufacturing Production Credit is a tax credit for the domestic production of solar and wind energy components, inverters, battery components, and critical minerals. The credit for critical minerals is permanent, unlike credits for other items, which will phase out in 2032.

Other climate funding in the IRA

In addition to the policies above, the IRA sanctions another $116 billion for clean energy and climate programs.

This includes incentives for clean hydrogen production, electric vehicle purchases, and alternative fuels. Furthermore, the Department of Energy receives around $9.8 billion for clean energy innovation and infrastructure loan and grant programs.

The act also invests in environmental conservation and rural development. It includes an estimated $9.6 billion in assistance for rural electric cooperatives, along with other incentives for energy efficiency and renewable energy.

With billions in climate funding, the Inflation Reduction Act is set to provide a significant boost to America’s clean energy plans. According to an assessment by the Department of Energy, the IRA could help reduce economy-wide GHG emissions to 40% below 2005 levels by 2030, marking a major milestone on the road to net-zero.

(This article first appeared in the Visual Capitalist Decarbonization Channel)

Strategic minerals supply chain review

Originally posted on Resourceworld.com

The demand for critical minerals has become increasingly important due to their widespread use in advanced technologies, such as aerospace, defence, computing, telecommunications, and a plethora of clean technologies such as solar panels and electric vehicle batteries. China has become the dominant leader in refining strategic minerals, while the rest of the world struggles to secure domestic supply lines through new mineral discoveries or make alliances with other nations in an attempt to reduce reliance on China. Often it is the case that these alliances are in the third world where critical mineral deposits are bountiful, however lack of proper infrastructure hampers efforts to extract and refine the essential raw materials.

As a matter of national security and in response to China and Russia pursuing further access to strategic critical minerals outside their borders, the US Government designated lithium amongst others as “Critical Minerals” of strategic importance in December 2017 (Executive Order 13817). This order in effect is the USA’s strategy to ensure security and reliable supply lines for these critical minerals. The strategy aims to further reduce reliance on third parties by beefing up supplies favouring domestic sources of these critical raw materials. Canada too has agreed to this, in effect resulting in new discoveries in north America supplying the domestic market.

The critical minerals supply chain can vary depending on the country and its specific needs, but some commonly identified critical minerals include:

Lithium – batteries for electric vehicles and energy storage systems.

Cobalt – rechargeable batteries, especially those in electric vehicles.

Rare earth elements (REEs) – used in a variety of technologies, including magnets, wind turbines, and smartphones.

Graphite – lithium-ion batteries and other energy storage systems.

Platinum group metals (PGMs) – catalytic converters for automobiles and in fuel cells for electric vehicles.

Nickel – stainless steel, batteries, and other applications.

Copper – electric wiring, motors, and transformers.

Titanium – aerospace and defence applications, as well as in medical implants and sporting goods.

Tungsten – manufacturing and construction, as well as in electronic and defence systems.

Aluminium – transportation, construction, and packaging.

The growing demand for these minerals is predominantly being driven by the global transition towards a low carbon economy, which demands the deployment of clean energy technologies, such as renewable energy sources. Adding to the mass hysteria surrounding this transition, governments around the world have identified several key industries as being the top polluters regarding carbon emissions. The automotive sector, ranking close to poll position, has in some jurisdictions such as Europe been tasked with producing a green fleet, in which by the year 2035, all new vehicles must be net zero emissions. A huge task one might say, but achievable should the supply and security of the necessary minerals uphold. Governments globally are battling with this issue of supply, international markets are becoming increasingly competitive as nations slowly realise the importance these minerals have to play in the short term future of life as we know it.

Currently at the forefront of many jurisdictions critical minerals shortlist is lithium. The battery metal is of high importance due to its crucial role in the lithium ion battery. Presently, this market is headed up by China, owning directly or indirectly 80% of current global lithium resources. This poses a threat to other jurisdictions such as the USA and Europe, with little in the way of domestic supply, these jurisdictions have become reliant on a foreign source for its energy requirements. Some nations have taken proactive approaches to address the issue of domestic supply, such as the UK, who in July of last year, launched a data centre for critical minerals, the sole purpose of which is, to analyse data pertaining to the supply of critical minerals, in particular lithium and cobalt, again key players for the green transition.

The US Government too has endeavoured to establish domestic supply in order to wean off the currently owned Chinese supply lines. The push for domestic sources has materialised in the form of 2017 bill, in which lithium amongst other commodities was designated a “critical mineral of strategic importance”. The US aims to encourage domestic supply lines, by incentivising the identification of these minerals through exploration and mining activities whilst simultaneously reducing timelines by streamlining permitting processes.

Similarly, the EU has put forward a Critical Raw Materials Act, in which the continent outlines a road map on how it shall become the first climate neutral continent on Earth. In this plan the EU too aims to lessen its reliance on the quasi-monopoly that is China for supply, by sourcing its own critical minerals achieved through funding domestic projects. In the recent past, the EU has not been the most welcoming in relation to mining, particularly on the mainland continent, due to the abundant urban sprawl the jurisdiction has seen, leading Europe to be the second most densely populated continent on the planet. However, support in the form of the Critical Raw Material Act is here. Europe is now beginning to realise the importance of domestic mining in the supply chain for these critical minerals. The old adage of “not in my backyard” one might say is finally becoming obsolete.

Elsewhere, other “like minded nations” are chasing homogenous paths, with Japan and South Korea all looking to reduce their reliance on China for supply and beef up their domestic networks by supporting local projects. At present, the supply of many critical minerals is limited, and production is often concentrated in a handful of countries, which raises concerns regarding supply disruptions, price volatility, and geopolitical risks. The need for nations to source domestically is paramount as we, as a whole, transition into the “green world”.

So with the limited supply where are the current critical minerals being produced and by whom? Firstly looking at the lithium market, currently topped by Australia, boasting 53% of the commodity’s global supply, followed by Chile, China and Argentina respectively. Australia, one of the global mining powerhouses, lays claims to several producing and newly emerging lithium deposits. Both mid-tier and large miners have hands in the game, with the likes of Mineral Resources [MIN-ASX] and Pilbara Minerals [PLS-ASX] at the forefront.

Pilbara minerals operate the Pilgangoora deposit, located near Port Headland in Western Australia. The project is one of the largest hard rock lithium deposits globally and is considered strategically important within the lithium global supply chain.

The United States are becoming significant producers of lithium, with Albemarle’s [ALB-NYSE] Nevada based Silver Peak project being the jurisdictions sole producing operation. Presently Nevada, is a hotspot for US lithium. Recently, General Motors announced a US$650 million in Lithium Americas Corp. [LAC-NYSE], the funding will be geared at aiding in developing Lithium Americas Nevada based, Thacker Pass lithium mining project. General Motors’ significant investment in Lithium Americas stands testament to how crucial establishing secure supply is for maintaining industry as the green fleets begin to roll out. In addition to heavy investment from private entities, Government loans and grants are readily available to further incentivise the exploration and mining activities, with Nevada based operations seen to uptake a high proportion of these incentives. This proactive line taken by the US Government, has led Nevada to be ranked as the top jurisdiction globally for investment based on the Fraser Institute’s Investment Attractiveness Index, which rates regions on both their geological attractiveness, coupled with the effects of government policy on attitudes towards exploration investment.

Hoping to join Albemarle in the production ring is Century Lithium [LCE-TSXV; CYDVF-QTCQX]. Century’s Clayton Valley lithium project located in Nevada, is one of America’s largest lithium deposits, steadily advancing towards production. Situated proximal to America’s sole lithium producer Albemarle, Century looks to be in a prolific region for this critical commodity. Covering approximately 5,500 acres in central west Nevada, boasting a +40-year lifespan, an IRR (Internal Rate of Return) of 26% and a NPV (Net Present Value) of US$1.03B, the project is well on its way to production.

To date, the project holds 6.3M tonnes of Lithium Carbonate Equivalent (LCE) in indicated resources, with a further 1.28M tonnes LCE in probable reserves.

In March 2021, a Pre-Feasibility study incorporating sulfuric acid was conducted for the project, key findings of which include:

Average mine production of 27,400 tonnes LCE annually

40-year lifespan

Net lithium recovery 83%

Operating cost US$3,387/tonne

Sales at base rate of US$ 9,500/tonne lithium carbonate

Capital investment (estimate) US$493M.

NPV US$1.03B

The deposit itself is simple, flat lying in nature, with lithium rich clays extending to depths of 150m minimum from surface. The cover sequence is minimal with thin gravels comprising the overburden, thus negating the need for any drill and blast activities, overall lowering the cost of production. Crucial to the project, Century has obtained water rights to the area, an accolade not easily sought, which will be instrumental to the project’s success down the track. The project too boasts the largest lithium pilot plant in the USA, having been functioning for the past 18 months. In addition, Century has commenced collaboration works with Koch Technology Solutions (a Koch Engineered Solutions company), a leader in membrane filtration and ion exchange technologies, to provide engineering design and cost data for the full-scale DLE portion of the processing plant. On top, Koch is focused on further improving the already exemplary recovery of 99.5% within the DLE portion of the Pilot Plant.

Furthermore, last September, Century achieved a significant milestone with the production of enhanced battery grade lithium carbonate (Li2CO3) of 99.94% purity of product made from its lithium-bearing claystone. further increasing the project’s suitability for supplying the EV market.

Looking ahead, Century plans to execute a Feasibility Study, importantly Century will utilise hydrochloric acid and sodium hydroxide rather than the previously tested sulfuric acid to produce Li2CO3. A crucial change from the 2021 study, which will alter the projects Capex and Opex budgets. This second study is due for release later this year. Following the Feasibility Study, Century plans to complete its Plan of Operation and commence permitting for the project which is located fully within federal land. Current estimates show a 15–18 month timeline, with proactive governmental initiatives streamlining this process. Additionally, following the release of their upcoming Feasibility Study, Century plan to pursue strategic investors to aid in the project’s advancement, similar to what has recently transpired between Lithium Americas and General Motors. At present, global predictions suggest electric vehicles will attain 21% of new car sales in 2025 and further rise to 34% and 48% by 2030 and 2033 respectively. This all bodes well for Century’s Clayton Valley lithium project, continually advancing this project is Century’s top priority, we wait with bated breath to see further developments.

Stepping out of the lithium arena and delving into the nickel space, we see Canada Nickel Company [CNC-TSXV] and their Crawford Ni-Co project. Located in the Timmins-Cochrane area of Northern Ontario, Canada. The project is a large, undeveloped nickel-cobalt sulphide deposit with potential to become a significant source of nickel and cobalt for the electric vehicle and stainless-steel markets. Canada Nickel’s flagship has a current resource estimate of 263 million tonnes of nickel, cobalt, and iron, with significant potential for expansion. The deposit is hosted in a large ultramafic intrusion that is around 2.7 billion years old and covers an area of approximately 30 km by 15 km. The project contains the 5th largest nickel sulphide resource globally based on Measured & Indicated resources, with nickel demand forecast to grow by 20% in 2030, the push is on to see this project into the development phase. An exciting company and flagship to watch in the medium term.

Lastly, we cross back into the jurisdiction of the United States and look at Highland Copper’s [HI-TSXV; HDRSF-OTCQB] Copperwood Project. Highland’s flagship, the Copperwood project, located in the Upper Peninsula of Michigan, USA. The project is a high-grade copper deposit that has a current resource estimate of 47 million tonnes grading at 1.5% copper. Hosted within a volcanic complex the project has significant potential for expansion both along strike and at depth. Recently, Highland announced an updated Feasibility Study highlighting a robust 17.6% IRR at a copper price of $4.02 per pound. With copper prices set to soar, boasting a fully permitted, feasibility tested project, is a huge asset to hold in storage. Exciting times lay ahead for Highland, let’s see how long they can hold on to their budget value CA$0.095 share price.

The outlook for critical minerals appears strong yet complex, while growing demand for these minerals is likely to continue dominantly driven by the energy transition, geopolitical risks, environmental concerns, and technological developments may all play a part in shaping the future of the critical minerals.

Canada, South Korea sign critical minerals deal in bid to reduce China dependence

Originally posted on Globalnews.ca

Canada and South Korea have agreed to co-operate on supply chains for critical minerals needed for electric vehicles as both countries work to strengthen their economic ties and reduce their dependence on China.

“We recognize – both of us – that China is an important economic partner, not just in the region but around the world,” Prime Minister Justin Trudeau said Wednesday in Seoul at a joint news conference with South Korean President Yoon Suk Yeol.

“But we need to be clear-eyed about where we co-operate with China,” Trudeau added, noting that Canada co-hosted a United Nations summit on biodiversity in Montreal last year.

“We need to know where we’re going to be competing with China on economic grounds and where we need to challenge China on human rights and other issues,” he said.

“It’s something that we will both be continuing to do in ways that make sense for our own countries and our own situations.”

During Trudeau’s first official trip to South Korea, he signed a memorandum of understanding on critical minerals, the clean energy transition and energy security, which he said will mean more investment and trade for Canada.

The Prime Minister’s Office said that both countries can play a “leading role” as “reliable partners” when it comes to the supply chain for electric vehicles and the critical minerals needed to make their batteries.

Trudeau’s visit to South Korea follows on commitments from both countries to strengthen economic and military ties to counterbalance the influence of China.

Both countries have released Indo-Pacific strategies within the past year, which provide road maps for strengthening military and economic relationships in the region to counterbalance the influence of Beijing.

The agreement on critical mineral supply chains comes as Canada’s federal government is in a dispute with automaker Stellantis, which has halted construction on an electric-vehicle battery plant in Windsor, Ont., in partnership with South Korean battery-maker, LG Energy Solution.

The companies jointly wrote to Trudeau last month after Volkswagen announced it had secured a deal to set up a battery plant in St. Thomas, Ont. That deal had Canada offering a $700-million capital contribution and $8 billion to $13 billion in production subsidies to match what Volkswagen would get in production tax credits under the U.S. Inflation Reduction Act.

The federal government has said it is negotiating with Stellantis, but wants Ontario to contribute a bigger share of the money than the $500 million in capital costs it has put on the table.

Trudeau had little to add when asked about Stellantis in Seoul.

“Canada has been successfully delivering great jobs for the middle-class across the country through investments by partners from around the world. We will continue to do that,” he said.

The visit also produced a renewed arrangement on youth mobility, with an annual quota of 12,000 people.

“We welcome thousands of Korean students to our universities every year and now, we want to do even more,” said Trudeau, adding it will create new opportunities for youth to work in both countries.

Canada and South Korea also committed to working together to advance human rights in North Korea, where Trudeau said the federal government will continue to support human rights organizations.

“We continue to deplore the regular military activities including nuclear missile tests by North Korea, that destabilize not just the region but threatens the security of the entire world,” Trudeau said.

He highlighted what Canada is doing to enforce maritime sanctions against North Korea through Operation Neon.

The growing threat of authoritarianism around the world was a theme in Trudeau’s address to the South Korean National Assembly earlier Wednesday.

He said “antagonistic countries” are taking advantage of economic interdependence to their own geopolitical advantage.

He said the “world is facing a moment of uncertainty” as countries recover from the COVID-19 pandemic, while economic anxiety and climate change add stress to people’s lives.

He argued Canada and South Korea can be partners in addressing climate change, which he says is also a way to safeguard against geopolitical instability and build more resilient economies.

Indonesia became second largest cobalt producer in 2022 – Cobalt Institute

Originally posted on Mining.com

Indonesia became the world’s second-largest cobalt supplier last year, behind top ranked Democratic Republic of Congo, as it accounted for almost 5% of global production of the battery material, according to data from UK-based Cobalt Institute.

Cobalt is a key ingredient for the rechargeable lithium-ion batteries used in electric vehicles, sales of which are expected to accelerate over coming years as the auto industry moves to meet emissions targets.

Indonesia’s production of cobalt surged to 9,500 tonnes in 2022 from 2,700 tonnes in 2021, according to the institute.

“Indonesia became the second largest cobalt producer, overtaking established producers including Australia and the Philippines,” the Cobalt Institute said. “Indonesia has the potential to increase cobalt production by 10 times by 2030.”

Australia produced 7,000 tonnes of cobalt last year and 5,900 tonnes in 2021 when it was the second largest producer. Output in the Philippines was 5,400 tonnes last year.

Total cobalt production last year was 198,000 tonnes. Congo’s share of that was 145,000 tonnes of cobalt or 73%, the Cobalt Institute said in a release, adding that global demand rose 13% to 187,000 tonnes in 2022.

“Cobalt supply growth continued and demand stumbled, particularly for portable electronics… cobalt metal prices halved from the April peak to year end,” the institute said.

CME Group’s cobalt contract shows prices fell more than 60% to $15 a lb over the last year.

A breakdown of the data from the institute shows electric vehicles accounted for 74,000 tonnes or nearly 40% of total demand last year compared with 56,000 tonnes or 34% in 2021.

(By Pratima Desai; Editing by Susan Fenton)

New sponge can remove toxic metals, recover critical minerals from contaminated water

Originally posted on Mining.com

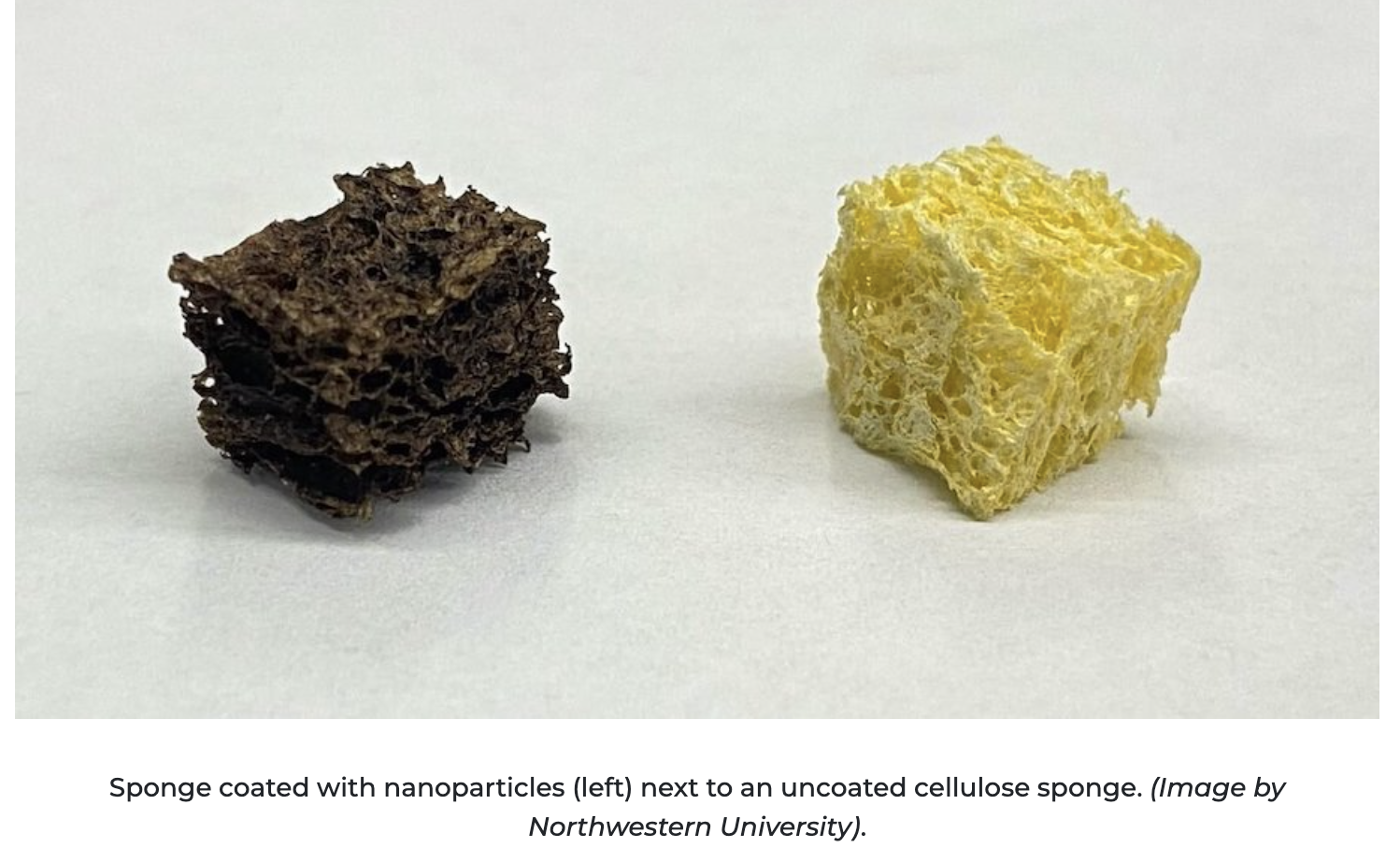

Northwestern University engineers have developed a new sponge that can remove metals—including toxic heavy metals like lead and critical metals like cobalt—from contaminated water, leaving safe, drinkable water behind.

In a paper published in the journal ACS ES&T Water, the researchers explain that they tested their new sponge on a highly polluted sample of tap water, containing more than 1 part per million of lead. With one use, the sponge filtered lead to below detectable levels.

After using the sponge, they were also able to successfully recover metals and reuse the sponge for multiple cycles.

“The presence of heavy metals in the water supply is an enormous public health challenge for the entire globe,” Vinayak Dravid, senior author of the study, said in a media statement. “It is a gigaton problem that requires solutions that can be deployed easily, effectively and inexpensively. That’s where our sponge comes in. It can remove the pollution and then be used again and again.”

Dravid noted that this project builds on his previous work developing highly porous sponges to clean up oil spills. The nanoparticle-coated sponge is now being commercialized by Northwestern spinoff MFNS Tech.

But in the researcher’s view, this wasn’t enough.

“When there is an oil spill, you can remove the oil but there also are toxic heavy metals—like mercury, cadmium, sulphur and lead—in those spills. So, even when you remove the oil, some of the other toxins might remain,” he pointed out.

Manganese to the rescue

To tackle this issue, Dravid’s team, again, turned to sponges coated with an ultrathin layer of nanoparticles, in this case, manganese-doped goethite. Not only are manganese-doped goethite nanoparticles inexpensive to make, easily available and nontoxic to humans, but they also have the properties necessary to selectively remediate heavy metals.

“You want a material with a high surface area, so there’s more room for the lead ions to stick to it,” Benjamin Shindel, first author of the paper, said. “These nanoparticles have high-surface areas and abundant reactive surface sites for adsorption and are stable, so they can be reused many times.”

The team synthesized slurries of manganese-doped goethite nanoparticles, as well as several other compositions of nanoparticles, and coated commercially available cellulose sponges with these slurries. Then, they rinsed the coated sponges with water to wash away any loose particles. The final coatings measured just tens of nanometers in thickness.

When submerged in contaminated water, the nanoparticle-coated sponge effectively sequestered lead ions. The US Food and Drug Administration requires that bottled drinking water is below 5 parts per billion of lead. In filtration trials, the sponge lowered the amount of lead to approximately 2 parts per billion, making it safe to drink.

From there, the team rinsed the sponge with mildly acidified water. The solution caused the sponge to release the lead ions and be ready for another use. Although the sponge’s performance declined after the first use, it still recovered more than 90% of the ions during subsequent use cycles.

This ability to gather and then recover heavy metals is particularly valuable for removing rare, critical metals, such as cobalt, from water sources.

“For renewable energy technologies, like batteries and fuel cells, there is a need for metal recovery,” Dravid said. “Otherwise, there is not enough cobalt in the world for the growing number of batteries. We must find ways to recover metals from very dilute solutions. Otherwise, it becomes poisonous and toxic, just sitting there in the water. We might as well make something valuable with it.”

Canada’s EV battery supply chain surpasses U.S., a close 2nd to China

Originally posted on Investontario.ca

Canada’s major growth in the EV and auto manufacturing sectors reflected in BloombergNEF 2022 global ranking

This year Canada saw a historic rise to second place in the BloombergNEF’s 2022 global lithium-ion battery supply chain ranking. The nation surpassed the United States, placing a close second to China.

Canada’s strengths in raw materials, environmental, social and governance factors (ESG) factors and industrial infrastructure helped it jump three spots from fifth to second in just one year.

Canada’s rise in the rankings “reflects its large raw material resources and mining activity, as well as its good positioning in [ESG] and infrastructure, innovation, and industry,” says BloombergNEF in an article released accompanying the report.

Canada impressively ranked within the top 10 of each key theme: availability and supply of raw materials (3rd); manufacturing of battery cells and components (8th); local demand for electric vehicles (EVs) and energy storage (10th); infrastructure, innovation and industry (4th) and finally, environmental, social and corporate governance (ESG) (6th).

“Canada’s recent investment in its upstream clean energy supply and increasing demand in the US-Mexico-Canada Agreement (USMCA) region increases the country’s competitiveness,” says BloombergNEF.

Ontario—Canada’s economic engine—has proved to be an EV battery powerhouse and a vital contributor to the country’s battery supply chain. As a jurisdiction, the province unto itself has an end-to-end ethical supply chain for battery production.

When it comes to critical minerals, Ontario boasts $11 billion in annual mineral production and produces a third of Canada’s nickel and a quarter of the country’s cobalt and copper, all necessary for the production of EV batteries.

The province has truly become a hub for tomorrow’s EV. Ontario has had more than $16 billion in recent investments from automotive and EV battery giants such as Honda ($1.4B), Umicore ($1.5B), Ford ($1.8B), GM ($3B), Stellantis ($3B) and a Stellantis and LGES partnership ($5B). And we’re just getting started!

Battery Metals stocks set to wade into the coming supply demand crunch

Originally posted on Proactiveinvestors.com

To build a clean energy future, a wide range of minerals and metals are required.

From copper to nickel to graphite, lithium, manganese and vanadium, to name a few, so called battery minerals and metals will fuel the technology revolution.

And from electric vehicles to computer chips, medical equipment and much more, these commodities will be wide ranging in their usefulness.

In this article, we'll look at three battery metals and various companies in this space including graphite, manganese and vanadium.

In this article:

The EV market continues to grow

Global electric vehicle industry sales grew more than 50% from 2021 to 2022, making up a total of 14% of all new cars sold in the world.

China’s sales have eclipsed its 2025 target, while in Europe sales have increased by over 15% leading to 20% of all sales being EVs.

Australia lags behind, with only 3.8% of its total new vehicles sales made up of EVs.